SML Advisory Market Update

We are currently in an economic recession according to the way a recession was defined when I went to college in the 90’s. Our government will not tell you we are in a recession because it is an election year and the “R” word is never used by the government if it can be avoided. The numbers the federal reserve uses are mathematically manipulated to fit the narrative they are selling to the working class. Hence, they are not very reliable.

I like to use my own research to try and figure out how the economy is really doing. I find the actual numbers from corporate quarterly earnings reports are the best way to tell if the economy is slowing down. The numbers do not lie; the macro economy is definitely slowing down.

Corporations are making less money because of two main factors. 1. Their input costs are going up and the ability to pass along those costs is becoming extremely difficult in most cases. 2. People are feeling financially stressed and are consuming fewer products. Not because they don’t want or need them, but because they can’t afford them.

In my opinion, interest rates at 5.25% are starting to take a real bit out of working class budgets. For the last 40 years people have become more and more dependent on credit cards to help pay for things like entertainment, home repairs, medical bills and vacations. Now those credit card bills are taking a much bigger part of their monthly budgets which means they don’t have any extra money to spend. they are starting to fall behind on their payments. This is creating financial stress that is starting to be felt by many businesses.

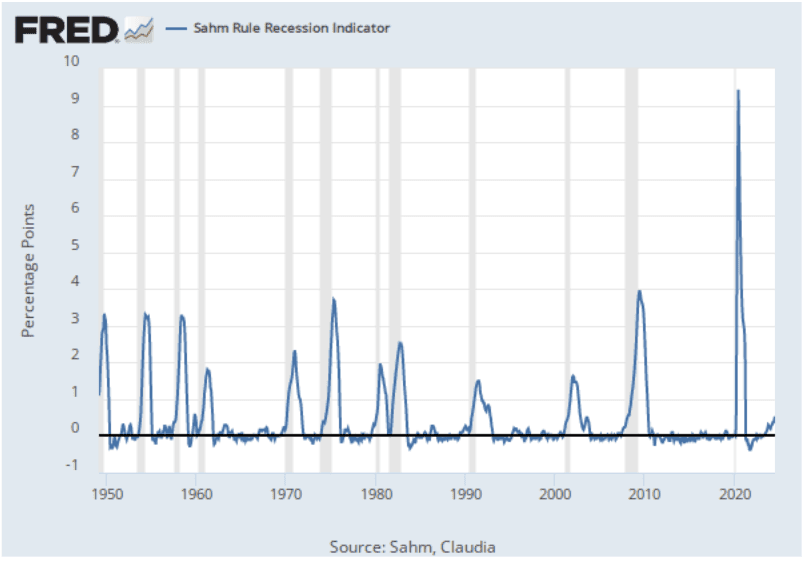

According to the numbers in the last jobs report on 8/2, 114,000 new jobs created vs 176,000 expected, and down from 206,000 new jobs in June, the US economy is slowing down. This unexpected drop in new employment triggered the Sahm rule which has been the most accurate recession indicator the Federal Reserve uses with a 100% accuracy of indicating t he past recessions going back to 1950.

The stock market is signaling a recession as well. Since the peak on July 16th, the S&P 500 index is down 481 points on a closing basis. This is an 8.5% drop in value led by technology which has grown to the heaviest weighted portion of the index and was overdue for a correction in my opinion. The Nasdaq peaked earlier on July 10th and has dropped by 2447 points, or 13.1% at the close today. US corporate earnings grew by 10% on average compared to July of 2023. However, the stock market is signaling that this is not going to continue into 2025. I expect that there is more downside risk to most stocks than there is upside potential due to the fact that the economy is noticeably slowing down even though the Gov’t numbers are not confirming a recession just yet. Therefore, the big question for the stock market is; how low do we go?

There is no way to know for sure, but we can come up with a decent guess by combining the information we believe to be true regarding corporate earnings and the economy with technical analysis. According to technical analysis of the stock charts, we are most likely going to test the last correction low set on 04/19/24 of 4967.23. If the stock market stops at this point and starts going back up then it is a sign that we are just slowing down and not going into a full blown recession. However, if this level is tested and broken to the downside; we are definitely going lower. The next stop after the April low, on the S&P 500 index, is 4,687 which is the low on 01/04/24. The combination of a slowing economy and a stock market that is breaking down technically tells you that the smart move is to be in cash or shorting stocks for the next few weeks at least.

Maximizing Social Security Benefits

Optimize Social Security benefits through strategies like delaying, spousal benefits, and understanding claiming age impacts.

The Role of Health Care in Retirement

Understand healthcare planning in retirement, covering Medicare, long-term care, and managing healthcare costs effectively.

Subscribe to my Newsletter

Stay informed and empowered on your retirement journey with our exclusive newsletter. Receive expert insights, tips, and updates straight to your inbox. Subscribe today for valuable guidance towards a secure financial future

Copyright © 2024 SML Advisory - All Rights Reserved.